Decide on a strategy that is right for you

Dollar Cost Averaging

Dollar-cost averaging (DCA) is an investment strategy in which an investor divides up the total amount to be invested across periodic purchases of a target asset in an effort to reduce the impact of volatility on the overall purchase. No one can predict where the market is going at any given time, so why even try? Putting your money in an investment all at once - thinking it will only go up - can be a very risky idea. By following a simple practice known as dollar cost averaging, you can protect yourself against market fluctuations and downside risk in the market. By buying a fixed dollar amount on a regular schedule, your focus is on accumulating assets on a regular basis, instead of trying to time the market.

Plan to be spontaneous tomorrow.

Why DCA makes sense

With dollar cost averaging, you take a lot of the emotion and fear out of investing because where the market goes in the short-term is far less important to you, as long as you stick to a regular investment plan. If cryptocurrency enters a bear market and your investment falls in value, you’d just end up buying more tokens at a lower price.

For example, let’s say at the beginning of this year, you put $100,000 all at once into a cryptocurrency priced at $100 a coin. By the end of the year, a recession or a dip in the market hits and the coin declines to $70, a 30% loss of $30,000. Instead, what if you evenly distributed your money over the course of the year? Let’s say you decide to invest $25,000 each quarter. When the coin is down, you end up purchasing more coins, and when it’s up, you purchase less coins. This increases the number of coins you purchase and also decreases your average coin price. Instead of holding 1,000 coins valued at $70,000, and losing 30% or $30,000 on your initial investment, you’d hold 1,197 coins valued at $83,790, losing 16% or $16,210 on your initial investment.

Let’s take another example. Here, your chosen coin starts the year at $100 per coin, and then finishes at $90. If you bought at the start of the year, you’d have lost 10% or $10,000. You could have made money dollar cost averaging, even if the coin ends the year down in price. At the end of the year, you would have made $4,580, compared to a $10,000 loss under the other scenario.

The bottom line is that with dollar cost averaging, you can reduce market risk and build your investments over time, regardless of where the market is going.

What you should understand

There are a few things investors should understand before starting their own dollar cost averaging plan:

Dollar cost averaging is a strategy that is better suited for investors with a lower risk tolerance and a long-term investment horizon. This strategy makes the most sense when used over a long time period with volatile investments.

Next, the strategy is no guarantee of good returns on your investment. Dollar cost averaging into an investment that continues to fall each and every month is not a wise move.

Finally, investing involves risk and your own due diligence, so you should only dollar cost average into an investment that you understand and are comfortable with. You shouldn’t just set up an automatic investment plan and forget about the investment, either – it is probably a good idea to regularly check in on it.

Don't ignore the least risky cryptocurrencies

Bitcoin (BTC)

was the first cryptocurrency and the Bitcoin network has not been successfully hacked or broken since it was created in 2009. Don't worry about one single bitcoin being valued at many thousands of pounds. Bitcoins can be split into smaller units to ease and facilitate smaller transactions so you can buy fractions of a bitcoin. A satoshi is the smallest unit of a bitcoin, equivalent to 100 millionth of a bitcoin.

- It has zero counterparty risk.

- It knows no borders.

- It can never be debased.

- It can never be confiscated.

- It can’t be censored or sanctioned.

- It is divisible into 100 million units.

- It can be sent anywhere in the world at any time with final settlement in an hour.

- It exists outside of the existing fiat system which is on a completely unsustainable path.

Ethereum (ETH)

was the first alternative blockchain to introduce smart contracts written using the Solidity programming language and opening up the possibility of decentralised finance with globally distributed computing. There are other ecosystems offering these facilities but Ethereum has first-mover advantage and enjoys the largest community of developers. If Metcalfe's Law is valid then if one compared the rate of growth in the number of nodes and transactions on the Ethereum network to the rate of growth in the number of nodes and transactions on the Bitcoin network one might expect the value of ETH to increase more rapidly than the value of BTC. Officially launched in 2015 it has accumulated a staggering market capitalization nearing the half-a-trillion dollar mark. Ethereum is ranked as the world’s second-largest cryptocurrency (by market capitalization) and within a very short period of time has been center stage to some of the most extraordinary returns the world has ever seen.

Chainlink (LINK)

was the first "oracle" implementation enabling on-chain smart contracts to reference off-chain data from traditional IT systems such as SAP. The Chainlink network provides reliable tamper-proof inputs and outputs for complex smart contracts on any blockchain. The CEO of Chainlink is Sergey Nazarov. Chainlink introduced the ERC677 transferAndCall token standard that lowers transaction costs and enables staking and introduced Chainlink VRF that can generate verifiable random numbers for use in smart contracts. The LINK token is an ERC677 token that inherits functionality from the ERC20 token standard and allows token transfers to contain a data payload. It is used to pay node operators for retrieving data for smart contracts and also for deposits placed by node operators as required by contract creators. The Cross-Chain Interoperability Protocol (CCIP) facilitates the movement of data and value between existing systems and any public or private blockchain.

Marvin's Method

Rapid Response

The DCA approach described above is well suited to traditional stocks, ETFs or mutual funds. However, the special characteristics of the cryptocurrency market means that some tweaks or refinements to this approach can be beneficial. Instead of making quarterly investments, as suggested above, make it a smaller monthly investment. Analysis of how the cryptocurrency market has performed over the past few years indicates that the fourth Sunday of every month tends to be the optimum time to make your regular DCA purchase.

Depending upon market trends and new project opportunities consider investing in a different coin each month. Blockchain technology is developing at an extraordinary pace. Never become emotionally attached to a particular project or coin. The project that was the most innovative and exciting 3 months ago and has recently given you a great return on your investment may now be past its time for maximum growth.

If your chosen coin performed well in the past month it is quite probable that a different coin will perform better in the next month. So don’t always buy the same coin again, especially if the price now appears to be close to its all time high.

If your chosen coin performed poorly in the past month, don’t sell it at a reduced price but consider buying another cryptocurrency this month that may have more potential to significantly increase in value while you wait for the price of your last pick to recover.

Irrespective of whether your last month’s choice appears to have been good or bad take account of the overall market and the hype and trends in cryptocurrency to decide the best market sector from which to select a coin for the next month.

Diversify like Zaphod's two heads - don't bet it all on one

Be aware of the many different market sectors

Even in a bear market there will be certain types of cryptocurrency that are, in general, outperforming the rest. What we mean by market sector in this context is the category of “use case” for tokens that currently seem to be popular and are driving market trends. Some examples of “use case” are given below:

- Store of value (e.g. Bitcoin or Decred)

- Privacy (e.g. Monero or Zcash)

- Layer 0 security and settlement for efficient Layer 1 chains (e.g. Polkadot or Avalanche)

- Layer 1 smart contract platform (e.g. Ethereum)

- Layer 1 with scaling through adaptive sharding and/or parallelization (e.g. NEAR or SUI)

- Layer 2 Ethereum scaling solutions (e.g. Polygon (MATIC) or Arbitrum)

- Blockchain interoperability solutions (e.g. ZetaChain)

- Smart contract facilitator for enterprise (e.g. Chainlink or Unibright)

- Real World Assets (RWA) tokenisation (e.g. Ondo or Chintai)

- Co-ownership of AI agents (e.g. Virtuals Protocol)

- Decentralised computing "DePIN" (e.g. iExec RLC or Render)

- Decentralised data storage (e.g. FIL)

- Decentralised finance “DeFi” enabler (e.g. Maker or AAVE)

- Digital cash (e.g. Dash or Litecoin)

- Energy market (e.g. Energy Web Token)

- Currency exchange and interest yielding services (e.g. SwissBorg or Nexo)

- Web 3 identity (e.g. Lukso)

- Memes (find our more about memetics here)

- Social media (e.g. Theta)

- Gaming (visit our METAVERSE page for some early examples)

- Supply chain and logistics (e.g. Morpheus Network or VeChain)

- Securities trading (e.g. INX)

- Insurance (e.g. Etherisc or Nexus Mutual)

When you successfully ride a wave and seem to be making a profit don't forget to realise that profit by selling at least some of the coin before it slides back down into the next trough.

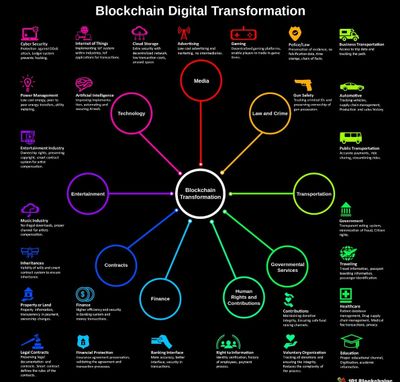

blockchain transformation

Consider using your crypto as collateral

Get some fiat back into your bank account without selling the crypto assets you've accumulated

Companies like Nexo enable you to use your cryptocurrencies as collateral against a fiat loan.

Even if you don't want to borrow fiat, you can earn interest on your newly added assets, buy, sell and swap more than 100+ assets on the Nexo exchange. But be aware that using crypto as collateral for a Nexo loan may be viewed by HMRC as an asset disposal and hence liable to capital gains tax because when it is transferred from your savings wallet into your credit wallet it effectively becomes Nexo's asset and not yours.

Learn about DeFi

You may wish to consider other earning opportunities

Simply investing for growth in a cryptocurrency's value isn't your only option. Some tokens in proof-of-stake (POS) blockchains incentivise you to contribute to the network's security by offering you passive income from the interest you can receive if you stake the tokens.

Some decentralised finance (DeFi) products reward you for locking away your coins for a period to provide liquidity in their trading platforms, but before staking you should beware of long lock-up periods that may compromise your investment agility.

One of the more recent concepts that has emerged is yield farming (also referred to as liquidity mining). It is a way to earn rewards with cryptocurrency holdings using permissionless liquidity protocols. It allows anyone to earn passive income using the decentralized ecosystem of “money legos” built on Ethereum. Yield farmers will use very complicated strategies. They move their cryptos around all the time between different lending marketplaces to maximize their returns. They’ll also be very secretive about the best yield farming strategies. Why? The more people know about a strategy, the less effective it may become. Yield farming is the wild west of Decentralized Finance (DeFi), where farmers compete to get a chance to farm the best crops.

Beware of "Impermanent Loss"

Automated Market Maker (AMM) technology has taken off in spite of one of DeFi's seldom publicised risks: Users who provide liquidity to AMMs can see their staked token lose value compared to simply holding the tokens on their own.

AMMs run the risk of under-performing a basic buy-and-hold strategy. Why "impermanent"? Because as long as the relative prices of tokens in the AMM return to their original state when you entered the AMM, the loss disappears and you earn 100% of the trading fees. However, this is rarely the case. More often than not, impermanent loss becomes permanent, eating into your trade income or leaving you with negative returns. The term "impermanent loss" might be more accurately described as "divergence loss".

Learn about DePIN

Decentralised Physical Infrastructure

These are blockchain protocols that incentivise decentralised communities to build & maintain physical hardware. Users supply hardware or software resources to the network & get token rewards.

DePIN projects can be grouped into:

• Physical Resource Networks (Sensor, Wireless)

• Digital Resource Networks (Compute, Bandwidth, AI, Storage)

• DePIN Module

Each sub-sector disrupts a $1T dollar industry, which means DePIN's upside potential is massive.

Messari predicts that DePIN could add $10T to the global GDP in the next decade (and $100T the decade after). The DePIN sector is projected to reach $3.5 trillion in the next four years.

Other opportunities

Join a DAO

DAO stands for Decentralized Autonomous Organization. It is decentralized because there is no formal leadership. It is autonomous because it can do anything the members decide. And basically it is just an organization.

The medium article linked by the button below outlines some advantages the DAO over the traditional company and suggests that DAOs will soon replace companies because the structural efficiencies are too powerful to ignore.

Liquidity provision: a high risk/high reward opportunity

The medium article linked by the button below is intended for experienced users. If you have never put assets into a liquidity pool, or don’t understand the difference between Uniswap’s v2 and v3 pools, then maybe you want to read a beginner’s guide to Uniswap pools. On the other hand, if you are a fast learner, you should understand everything in this article. We neither recommend nor endorse the content detail of this article but we reference it as a good introduction to some of the things you need to think about when seeking high returns from providing liquidity in a DEX.

Not every trend is your friend

Markets behave in cycles

- We've all heard of market bubbles and many of us know someone who's been caught in one. Although there are plenty of lessons to be learned from past bubbles, market participants still get sucked in each time a new one comes around. A bubble is only one of several market phases, and to avoid being caught off-guard, it is essential to know what these phases are.

- An understanding of how markets work and a good grasp of technical analysis may help you recognize market cycles.

- Cycles are prevalent in all aspects of life; they range from the very short-term, like the life cycle of a June bug, which lives only a few days, to the life cycle of a planet, which takes billions of years.

- No matter what market you are referring to, all go through the same phases and are cyclical. They rise, peak, dip, and then bottom out. When one market cycle is finished, the next one begins.

- The problem is that most investors and traders either fail to recognize that markets are cyclical or forget to expect the end of the current market phase. Another significant challenge is that even when you accept the existence of cycles, it is nearly impossible to pick the top or bottom of one. But an understanding of cycles is essential if you want to maximize investment or trading returns.

- Marvin recommends you read about Elliot Wave Theory.

Markets have resistance levels

- Technical analysts use support and resistance levels to identify price points on a chart where the probabilities favor a pause or reversal of a prevailing trend.

- Support occurs where a downtrend is expected to pause due to a concentration of demand.

- Resistance occurs where an uptrend is expected to pause temporarily, due to a concentration of supply.

- Market psychology plays a major role as traders and investors remember the past and react to changing conditions to anticipate future market movement.

- Support and resistance areas can be identified on charts using trendlines and moving averages.

Have fun looking at the colours

- Bitcoin’s Rainbow Chart is a fun way of looking at the long-term price trends of Bitcoin. It uses a logarithmic scale to plot Bitcoin’s price, and colour codes them to show investors whether they should be buying, selling, or HODLing.

- It is not an exact tool, but it does surprisingly well in terms of predictions and timing the cycle top and bottom, especially the latter.

Be aware of the likely

- Sometimes it make sense to be contrarian to popular market sentiment. Buy the dip, don't sell in the red.

- Statistically, September tends to be the worst month of the year for cryptocurrency prices so it can be a good time to invest then in readiness for "Uptober". There is a saying,

"Sell in May

And go away

Always remember

Come back in September."

Know what usually happens

- The Stock-to-Flow (S2F) model is a method used to quantify the scarcity of a commodity, primarily used for assessing the value of precious metals like gold and silver and, more recently, applied to Bitcoin.

Be prepared for the unlikely

- Seemingly random changes in financial markets have motivated the extensive use of stochastic processes in Technical Analysis (TA) for cryptocurrency markets. The chart shown above was created by Aurelian Ohayon, a proponent of TA. It suggests that one bitcoin could reach a price of around $400,000 US in 2025.

- Marvin says, "Not even I can predict the future. But it is wise to be aware of possibilities and to adjust your risk assessment using that knowledge."